As the 2026 tax season begins, millions of U.S. taxpayers are preparing to file their federal income tax returns and are eager to know when their IRS tax refund will arrive. Refund timing depends on several factors, including how you file, which credits you claim, and whether there are any issues with your return.This article explains the IRS tax refund schedule for 2026, estimated refund dates, expected refund amounts, and how taxpayers can check their refund status.

When Does the IRS Start Issuing Refunds in 2026?

The IRS typically begins accepting federal tax returns in late January 2026 for income earned during the 2025 tax year. Refunds are generally issued within 21 days after the IRS accepts an electronically filed return with direct deposit selected.

Paper returns and mailed refund checks take significantly longer to process.

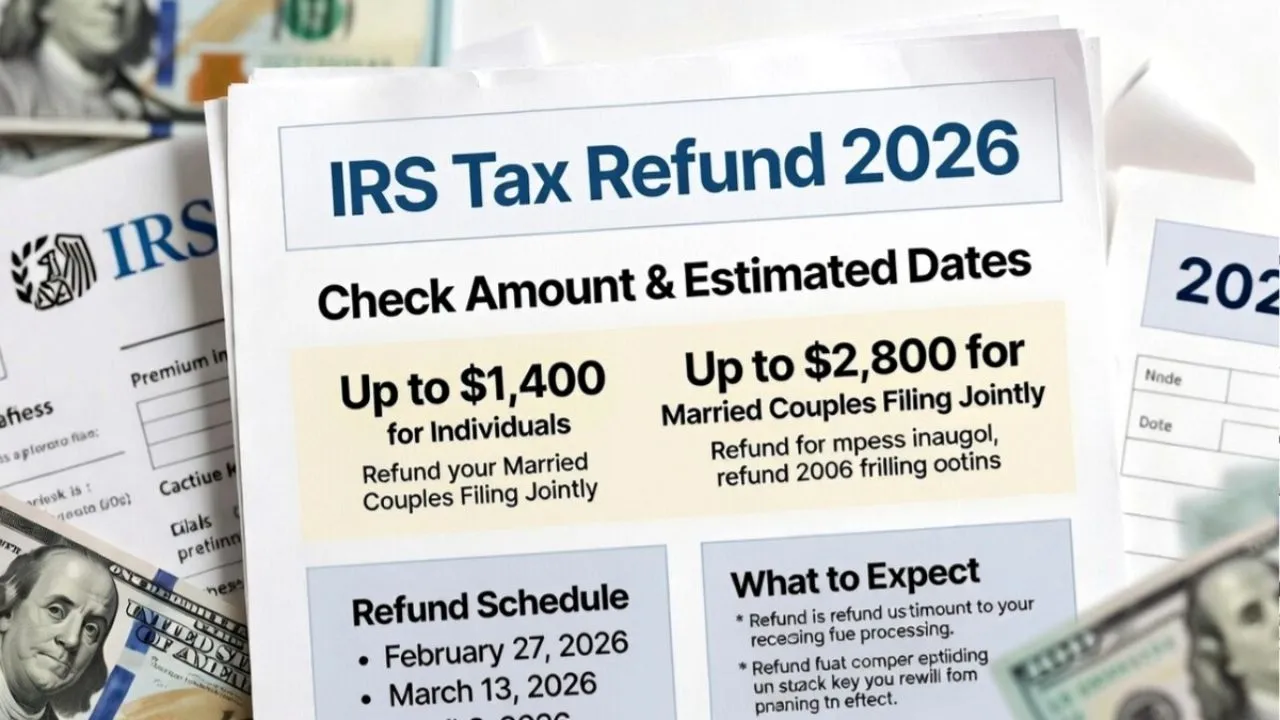

Estimated IRS Tax Refund Dates for 2026

The table below shows estimated refund allow dates for taxpayers who e-file their returns and choose direct deposit. These dates are approximate and may vary depending on individual circumstances.

Estimated Direct Deposit Refund Schedule

| IRS Accepts Return | Estimated Refund Date |

|---|---|

| Late January 2026 | Early February 2026 |

| Early February 2026 | Mid-February 2026 |

| Mid-February 2026 | Late February 2026 |

| Late February 2026 | Early March 2026 |

| Early March 2026 | Mid-March 2026 |

| Mid-March 2026 | Late March 2026 |

| Late March 2026 | Early April 2026 |

| Early April 2026 | Mid-April 2026 |

Taxpayers who file close to the April 15, 2026 deadline may receive refunds in late April or early May.

Why Some Refunds Are Delayed

Even if you file early, certain situations can delay your refund, including:

- Claiming the Earned Income Tax Credit (EITC)

- Claiming the Additional Child Tax Credit (ACTC)

- Errors in income, withholding, or Social Security numbers

- Identity verification or fraud review

- Filing a paper return instead of e-filing

By law, refunds that include EITC or ACTC cannot be issued before mid-February, even if the return is filed early.

Average IRS Refund Amount in 2026

While refund amounts vary widely, the average federal tax refund is expected to fall between $2,800 and $3,200 in 2026. Your actual refund depends on:

- Total income

- Federal taxes withheld

- Credits claimed

- Filing status

- Dependents

A larger refund often means more taxes were withheld during the year, not necessarily that you paid less tax overall.

How to Check Your IRS Refund Status

Taxpayers can check the status of their refund using the IRS “Where’s My Refund?” system. You’ll need:

- Social Security number or ITIN

- Filing status

- Exact refund amount

Refund statuses generally update once per day.

How to Get Your Refund Faster

To receive your refund as quickly as possible:

- File your return electronically

- Choose direct deposit

- Double-check all information before submitting

- Avoid claiming credits you don’t qualify for

- File early in the tax season

Final Thoughts

FAQ IRS Tax Refund 2026 Schedule

The IRS Tax Refund 2026 schedule follows a familiar pattern, with most electronically filed returns refunded within three weeks. Filing early, choosing direct deposit, and submitting an error-free return are the best ways to avoid delays and get your money sooner. As always, taxpayers should monitor their refund status and keep records in case the IRS requests additional information.

Q: When will the IRS start issuing tax refunds in 2026?

A: The IRS is expected to begin issuing refunds in early February 2026.

Q: How long does it take to receive a refund after filing?

A: Most e-filed returns with direct deposit are refunded within 21 days.

Q: What are the estimated IRS refund dates for 2026?

A: Late January filers may receive refunds in early February, February filers in mid to late February, March filers in March, and April filers in late April or early May.

Q: Why might my 2026 tax refund be delayed?

A: Delays can occur due to EITC or Child Tax Credit claims, filing errors, identity checks, or paper filing.

Q: When are refunds with EITC or ACTC issued?

A: Refunds that include EITC or ACTC are generally issued after mid-February.

Q: What is the average IRS refund amount in 2026?

A: The average refund is expected to range between $2,800 and $3,200.

Q: How can I get my refund faster?

A: File electronically, choose direct deposit, file early, and avoid errors.

Q: How can I check my IRS refund status?

A: You can check your status using your Social Security number, filing status, and exact refund amount.